Safe and Smart Investing Steps for Beginners

So you want to start investing, but the fear of losing money is holding you back? You’re not alone. Most beginners hesitate because investing feels risky and complex. The truth is: with the right first steps, you can grow your money safely and steadily. However, it requires both discipline and patience. In addition, consistency will help you grow over time.

👉 In this guide, we’ll break down the safest first steps for beginners — no jargon, no fluff, just practical steps you can take today.

Why Investing is Important

- Your money loses value if it just sits in savings due to inflation.

- It helps your money grow faster than a savings account ever could.

- The earlier you start, the more compound interest works in your favor.

How to Build Wealth in Your 20s and 30s: A Beginner’s Guide

Safest First Steps for Beginners When Investing

1. Start With a Clear Goal

Are you investing for retirement, a home, or financial freedom? Knowing your “why” helps you choose the right investments.

2. Build an Emergency Fund First

Before you invest, save at least 3–6 months of living expenses. This ensures you won’t be forced to sell investments during emergencies.

3. Begin With Low-Risk Investments

- High-yield savings accounts or money market funds (For example, safe, liquid, low return).

- Government bonds or treasury bills (safe, fixed income).

- Beginner-friendly ETFs or index funds (diversified, low-cost).

4. Automate Your Investments

Use apps or platforms that allow automatic monthly contributions. Consistency beats timing the market.

5. Learn Before You Leap

Read blogs, listen to podcasts, or take beginner friendly courses. The more knowledge you have, the fewer mistakes you’ll make.

Before investing, saving should come first. Budgeting also plays a key role. Choosing wisely and diversifying your portfolio will reduce risks. Finally, patience is essential for success.

Common Mistakes Beginners Should Avoid When Investing

- Chasing quick profits (high risk, high stress).

- Deal with the money you can’t afford to lose.

- Putting all money into one stock or asset (lack of diversification).

- Ignoring fees and hidden charges.

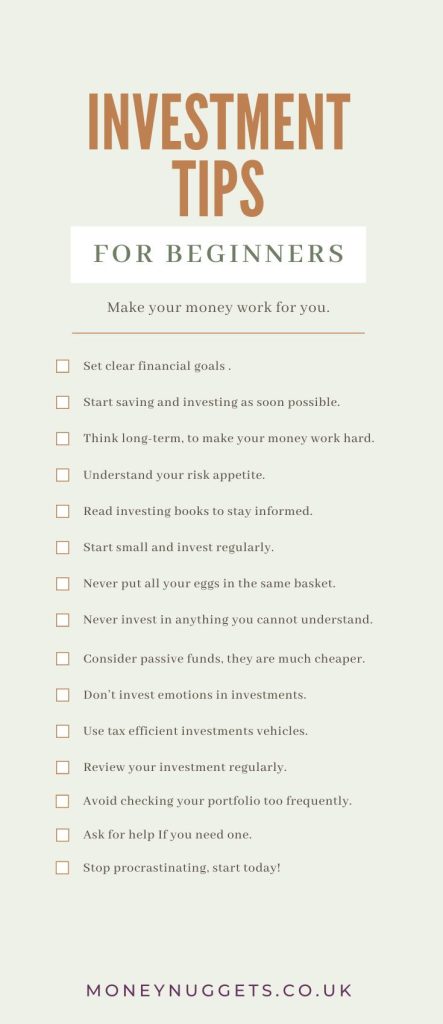

Quick Beginner Investment Checklist

- Emergency fund in place

- Defined investment goal

- Chosen a safe investment vehicle (ETF, bond, fund)

- Small, consistent monthly contributions set up

- Basic investing knowledge acquired

Always know this about Investing;

In summary, It doesn’t have to be scary. With the right foundation, even a complete beginner can start safely and confidently. Begin small, stay consistent, and remember: the goal isn’t to get rich overnight, but to build long-term wealth.

Check this

👉 Ready to take your first step? Subscribe to the Terces Finance Newsletter for weekly beginner-friendly finance and insurance tips.