Every Friday we answer the investing and tax questions readers ask most. This post gives short, actionable answers you can use today: how to start investing, which accounts lower your tax bill, basics of DCA, what to know about capital gains, and record-keeping tips for freelancers.

Quick takeaways

- Start small and automate (DCA).

- Use tax-advantaged accounts first (pension, IRA, or equivalent).

- Track receipts and income if you freelance.

- Long-term, low-cost index funds beat most active choices after fees.

- When in doubt, document everything and consult a tax pro.

Main FAQs — short, actionable answers

Q1 — How do I start investing with $50?

Start now. Choose a low-cost brokerage that supports fractional shares or low minimums. Pick a broad index ETF or fund. Automate a small monthly transfer. Track fees closely. Over time increase contributions as income rises.

Q2 — What is dollar-cost averaging and why use it?

DCA means investing a fixed amount regularly. It reduces timing risk and enforces discipline. It is ideal for new investors or when markets are volatile. It won’t always beat lump-sum investing, but it reduces regret and helps consistency.

Q3 — Which accounts reduce taxes most effectively?

Use tax-advantaged accounts your country offers: pension plans, employer matches, IRAs, RRSPs, etc. Contributions often lower taxable income or grow tax-deferred. Prioritize employer match—it’s free return.

- The Proven Strategy Behind Smarter, More Confident Financial Planning

- FIRE Movement 101: Can You Really Retire Early?

- How Delaying Your Retirement Savings Can Cost You Big

- Think Your Government Pension Is Enough? Here’s Why It’s Risky

- Retirement Planning: How to Win Big in Your 20s—and Catch Up in Your 40s

Q4 — How do capital gains taxes work?

Short-term gains (assets held < 1 year) are taxed at higher ordinary rates in many countries. Long-term gains often get lower rates. Rules differ by jurisdiction. Keep sale records and use tax-loss harvesting where appropriate.

Q5 — I freelance — which expenses can I deduct?

Common deductible items: Internet and phone (business portion), software, equipment, workspace, training, and professional fees. Keep receipts, log business use, and separate personal from business accounts.

Q6 — Does timing the market work?

Rarely. Even professionals miss big up-days by being out of the market. Focus on asset allocation, low fees, and consistency. Rebalance annually.

Q7 — How often should I rebalance my portfolio?

Annually is fine for most people. Rebalance sooner if allocation drifts more than 5–10% from target. Use new contributions to rebalance tax-efficiently.

Q8 — What records should I keep and for how long?

Keep receipts, invoices, and bank statements for at least 5–7 years (local rules vary). Store digital copies and categorize them. This helps audits and simplifies filing.

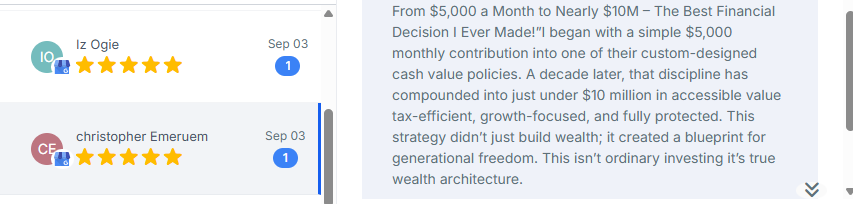

Mini case study

A reader started with $50/month into a total-market ETF and automated contributions. After 10 years at ~8% annualized return, they had contributed $6,000 but the account was worth ~$10,500. The lesson: time and consistency matter most.

Book a free 15-min review.