Passive investing (index funds, most ETFs) aims to match the market at low cost. Active investing (stock picking, active funds) tries to beat the market but costs more and often underperforms after fees. Which is right depends on your goals, time, risk tolerance, tax situation, and willingness to research. This post explains both styles clearly, gives a simple decision flow, shows where to place media and CTAs, and includes AIOSEO-ready details to publish quickly.

Quick takeaways

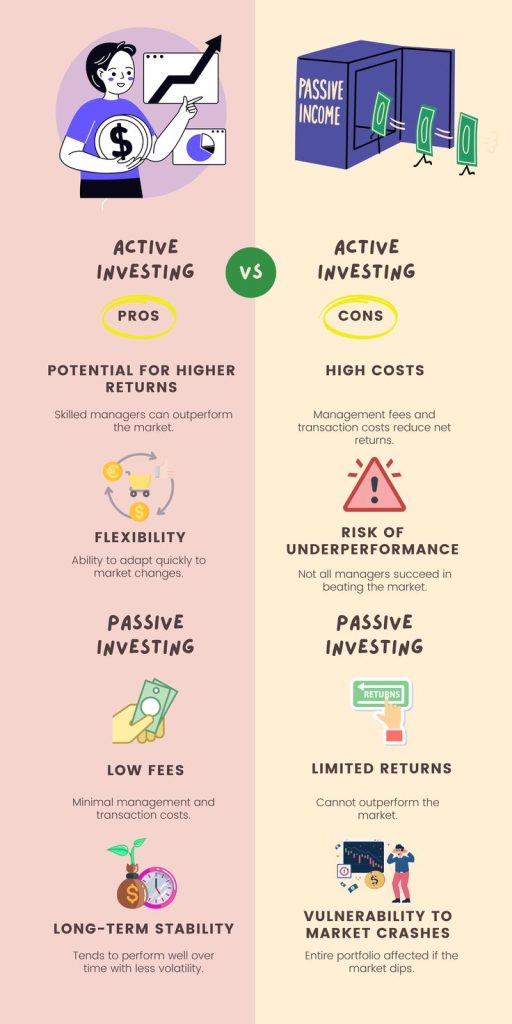

- Passive investing = low fees, broad diversification, set-and-forget.

- Active investing = potential for outperformance, higher fees, more hands-on.

- For most beginners and long-term savers, passive is the default best choice.

- If you have time, edge, or special knowledge, active can make sense for a portion of your portfolio.

- Use tax-advantaged accounts to hold active strategies that generate short-term taxable events.

Why Investing matters

Investing style shapes your returns. Fees, taxes, and behavior matter more than you think. Passive funds strip out costs and human bias. Active managers try to add value, but many can’t consistently beat the market after fees. This guide helps you pick a style that fits your life and financial goals.

What is passive investing?

Passive investing tracks an index. Examples: S&P 500 index funds, total-market ETFs. It aims to match index returns. It uses fewer trades and lower fees. Passive funds are tax-efficient. They are ideal for long-term goals and automated saving.

Pros

- Low expense ratios.

- Broad diversification.

- Easy to automate.

- Lower turnover → fewer taxable events.

Cons

- No chance to outperform the market (only match).

- Less control over holdings.

- The Proven Strategy Behind Smarter, More Confident Financial Planning

- FIRE Movement 101: Can You Really Retire Early?

- How Delaying Your Retirement Savings Can Cost You Big

- Think Your Government Pension Is Enough? Here’s Why It’s Risky

- Retirement Planning: How to Win Big in Your 20s—and Catch Up in Your 40s

What is active investing?

Active investing involves managers or individuals picking stocks or timing trades. The goal is to outperform a benchmark. Active strategies include stock picking, sector rotation, and tactical asset allocation.

Pros

- Potential to outperform benchmark.

- Flexibility to avoid bad sectors.

- Can exploit market inefficiencies.

Cons

- Higher fees (management + performance fees).

- Higher turnover → more taxes in taxable accounts.

- Hard to find consistently skilled managers.

- More time and attention required for DIY active investors.

Media slot: Insert screenshot of an active fund fact sheet showing fees and past performance (annotated).

Head-to-head: quick comparison

| Factor | Passive | Active |

|---|---|---|

| Cost | Low | High |

| Turnover | Low | High |

| Tax efficiency | High | Lower (often) |

| Best for | Long-term, autopilot investors | Short-term traders, specialized knowledge |

| Likelihood of beating market (net of fees) | No (matches) | Low — few managers beat consistently |

Who should pick passive?

Pick passive if you:

- Want simplicity.

- Want low fees and tax efficiency.

- Are saving for long-term goals (retirement, college).

- Prefer automation (DCA).

- Want evidence-based investing (studies favor passive for most investors).

Example: A young professional saving for retirement with monthly contributions should favor broad passive funds to maximize compounding after fees.

Who should pick active?

Pick active for a smaller portion if you:

- Have specialized knowledge (industry expertise).

- Enjoy research and market analysis.

- Want potential higher returns and accept higher risk.

- Want to hedge or tactically allocate a slice of your portfolio.

Example: An investor with deep experience in biotech might allocate a small active sleeve to exploit knowledge gaps, while keeping the core passive.

A practical hybrid approach (recommended for many)

- Core-satellite: Use passive funds as the core (70–90%). Use active strategies as satellites (10–30%).

- This combines low-cost broad exposure with targeted attempts to add alpha.

- Rebalance annually. Limit active exposure to what you can monitor.

Costs & taxes — the silent return killers

- Fees compound. A 1% difference can cut decades of growth.

- Active funds trade more. That creates taxable events in non-sheltered accounts.

- Use tax-advantaged accounts (IRAs, pensions) for active strategies when possible.

Action step: Always compare expense ratios and turnover before buying. Prefer tax-efficient ETFs for taxable accounts.

Simple decision flow (do this now)

- Define goal and time horizon.

- Check willingness to research & monitor.

- If low on time/knowledge → passive heavy.

- If high on expertise/time → consider a small active sleeve.

- Automate the passive core; limit active trades and track performance vs benchmark.

How to measure an active manager (if you use one)

- Compare net returns to a relevant index.

- Check the manager’s track record over 5–10 years.

- Examine fees and turnover.

- Look for consistency across market cycles, not one-time outperformance.

- Pay attention to drawdowns and risk-adjusted returns (Sharpe ratio).

Media slot: Table showing a sample active fund vs benchmark over 10 years.

30 / 60 / 90 day plan for readers

Next 30 days

- List all current holdings and fees.

- Identify your target asset allocation.

Next 60 days

- Move core of portfolio into low-cost index funds or ETFs.

- Set up automatic contributions.

Next 90 days

- If adding active exposure, allocate a small satellite sleeve and set rules (max 10–30%).

- Schedule an annual review.

FAQs – Passive vs. Active Investing

Q: Which style is cheaper — passive or active?

A: Passive is almost always cheaper due to lower expense ratios and turnover.

Q: Can active investing beat passive long-term?

A: Some managers do, but most fail to beat benchmarks net of fees consistently. That makes skill and cost critical.

Q: Should beginners ever try active investing?

A: Beginners should focus on passive first. If interested, start small and track performance vs benchmark.