To begin with, your credit scores are more than just numbers—it’s the key to financial opportunities like getting approved for loans, securing better interest rates, or even renting an apartment. However, many people don’t fully understand what actually influences it.

In this post, we’ll break down the truth about credit scores, what really affects them, and how you can improve it step by step.

What is a Credit Score?

It is a 3-digit number that reflects your financial trustworthiness. For example, lenders, landlords, and even employers may look at this number to assess how reliable you are with money.

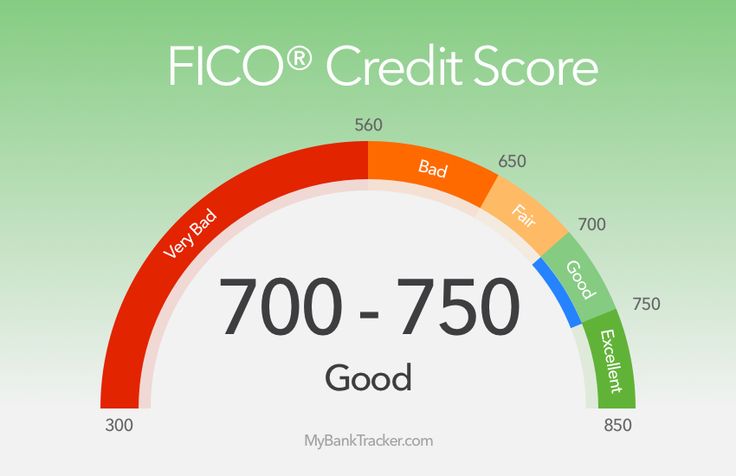

👉 Quick fact: Most scores range from 300 (poor) to 850 (excellent).

What Really Affects Your Credit Scores

Here are the main factors that go into your score:

- Payment History (35%) – Do you pay bills on time? Even one late payment can hurt.

- Credit Utilization (30%) – The amount of credit you use compared to your total limit. Consequently, you should aim to stay below 30%.

- Length of Credit History (15%) – Older accounts show stability. In fact, closing old accounts can lower your score.

- Types of Credit (10%) – Additionally, a healthy mix (credit card, car loan, mortgage) can help.

- New Credit (10%) – As a result, too many recent applications can make you look risky.

What Doesn’t Affect Your Credit Scores

On the other hand, it’s equally important to know what doesn’t impact your score:

- Income level

- Age, gender, or marital status

- Job title or employer

- Debit card usage

- Checking account balance

How to Improve Your Credit Scores

Instead, if your score isn’t where you want it to be, don’t worry—improvement is possible.

✅ Checklist to Improve Your Credit Score

- First, pay bills on time (set reminders or automate payments)

- In addition, keep credit utilization below 30%

- Moreover, don’t close old accounts unnecessarily

- Limit hard inquiries (only apply for credit when needed)

- Regularly review your credit report for errors

Check this downloadable/printable checklist PDF on Credit Scores

Why It Matters

Therefore, a strong credit score can help you:

- Qualify for loans with lower interest rates

- Get approved faster for apartments or rentals

- Enjoy better insurance premiums

- Build long-term financial confidence

Is My Side Hustle Tax-Deductible? AVA’s Exclusive Shocking Truth

Conclusion

Understanding your credit score is the first step to taking control of your financial future. Ultimately, now that you know what really affects it—and what doesn’t—you can start making smart decisions to improve your credit score and open the doors to better financial opportunities.

Want more practical money tips? Subscribe to the Terces Finance newsletter today!