However, if you’ve ever wondered, “Is my side hustle tax-deductible?”, you’re not alone. With the rise of gig work, freelancing, and small-scale entrepreneurship, many side hustlers are missing out on legitimate tax savings simply because they don’t know what qualifies. In this Ask AVA edition, we break down what the tax law says, the kinds of expenses you can deduct, and most importantly, the golden rules for staying compliant while keeping more money in your pocket.

Check out the Financial Services Industry: What You Should Know here.

What Does “Is My Side Hustle Tax-Deductible?” Really Mean?

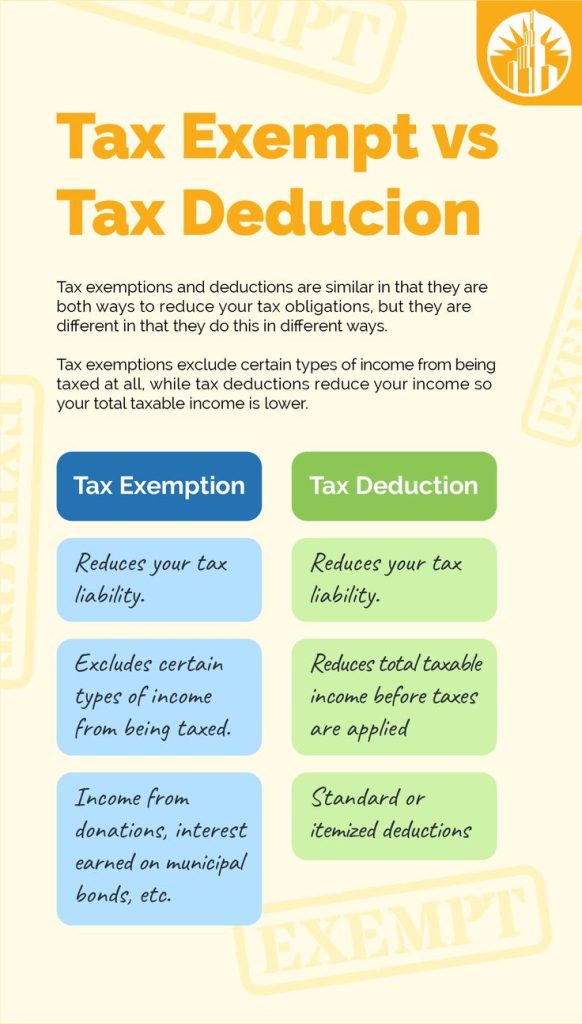

A tax-deductible expense is a cost you can subtract from your income to reduce the tax you owe. For example, in a side hustle, some purchases or services can legally lower your taxable income. However, they must meet the IRS (or your country’s tax authority) requirements.

Is My Side Hustle Tax-Deductible? Common Expenses You Can Claim

1. Home Office Costs

If you work from home, you may deduct a portion of rent, utilities, and internet costs based on the space you use exclusively for your side hustle. For instance, you can deduct equipment, supplies, and software used to run your side hustle.

2. Equipment & Supplies

This includes laptops, cameras, tools, or any physical supplies you purchase to deliver your services or products.

3. Marketing & Advertising

Website hosting, domain names, social media ads, business cards, and flyers can all be deductible.

4. Travel & Transport

If you travel for work purposes, keep receipts for transportation, fuel, accommodation, and meals (within allowable limits).

The Golden Rules for Claiming Deductions

1. Keep Records

Track every expense with receipts, invoices, and bank statements. Use apps like QuickBooks or Wave.

2. Separate Business & Personal Finances

Open a separate bank account for your side hustle to simplify tracking.

3. Only Claim Legitimate Business Expenses

If it’s not directly related to your side hustle, it’s not deductible. Over-claiming could trigger audits.

How Smart Tax Planning Helps Everyday People Build Wealth.

When a Side Hustle Deduction May Not Apply

Not every extra income qualifies as a business, On the other hand, not every cost qualifies as a deduction — personal expenses usually don’t. If you occasionally sell old clothes or bake for friends without a consistent profit motive, tax authorities may view it as a hobby — meaning no deductions allowed.

Final Takeaway – Is Your Side Hustle Tax-Deductible?]

The answer: It depends on how you run it. If your side hustle is a legitimate business with profit intent and you keep accurate records, you can likely deduct many expenses and reduce your tax bill. As a result, you could save hundreds in taxes by tracking your expenses carefully. Always check local laws or consult a tax professional to stay on the safe side.

Have more questions like “Is my side hustle tax-deductible?” Drop them in the comments below or reach out to AVA for tailored financial guidance.